Amazon opened 2022 with announcements targeting the smart home community that is forming around the Matter protocol and opportunities for IoT in non-residential sectors. These two initiatives are examples of how some large organizations are trying to have a “finger in many pies” to make the most of the variety and scope of IoT opportunities.

2022 closed with a flurry of Matter-compliant product launches from a range of large and small businesses. The year-long journey and commitment to an industry-alliance model point to a degree of realism about the IoT market. Behind the technology fanfare, they highlight how businesses and getting to grips with commercial market-development and the technical challenges associated with interoperability, both of which are needed for scale. Meaningful collaboration seems to be taking hold compared to “go-it-alone” strategies.

Several other corporate developments over the course of 2022 point to a growing sense of commercial and strategic realism. Many of the underlying issues involve individual organizations confronting their lack of market scale. Alternatively, they are dealing with the fact that their offering is either not unique or targets a limited portion of what is required to support a full IoT system. I highlighted the consequences of these supply-side characteristics in my closing comments of 2021. The growing band of IoT adopters require greater awareness of the risks of tying their businesses to a single vendor, a single solution-provider, or a proprietary technology. It seems that several providers grasped the commercial costs and long-term commitments associated with narrow strategies and responded with an exit maneuver.

Multi-strand Strategies

The decision to stay or exit the IoT market is an increasingly real challenge for large and vested players. They can see the large opportunity that IoT enables even if the pathway to large-scale and long-term commercial success is not entirely clear. How do they grasp the opportunities and stain the market for long enough to make solid commercial returns?

Amazon is one organization that is playing on multiple strands spanning connectivity, cloud infrastructure, developers and IoT data. Over the course of 2022, it launched initiatives in support of the Matter protocol and the smart home opportunity. Another initiative involved Amazon Sidewalk which operates a long-range, low-power IoT network using Bluetooth and LoRa radios built into Echo and Ring devices. The network connects devices to Amazon's cloud when they are beyond the reach of traditional homes. To partner with industries and organizations beyond the reach of the current network, Amazon added a new gadget to fill coverage gaps seeking to reach farms, factories and other nonresidential settings. Paralleling its own low-power network service, Amazon Web Services (AWS) entered into a strategic agreement with Semtech for asset tracking and monitoring solutions. The goal is to make Semtech’s LoRa Cloud global navigation satellite system (GNSS) geolocation services accessible to the AWS global developer community. In yet another initiative, AWS is also helping 1NCE to expand the global reach of its IoT platform by co-developing software that speeds up global deployment of IoT projects.

A second large organization is Vodafone. It focuses on cellular connected IoT devices, offering customers a global network supported over its home-grown IoT platform. One of Vodafone’s initiatives was an extension into the farming sector. Its MyFarmWeb service which is used by 7,200 farmers in other continents is being piloted across several European countries. Farmers can use a mobile app linked to agricultural IoT sensors and a cloud-based platform to store, visualize, and view information gathered via IoT sensors and other data sources in the field. They can then make informed decisions about soil and crop health, water use, and the application of fertilizers and pesticides. Vodafone also added to its healthcare sector activities. It partnered with Proximie to ‘digitise operating and diagnostic rooms’ through 5G, IoT and edge computing infrastructure provided by Vodafone Business.

In addition to its vertical sector initiatives, Vodafone seems to be experimenting in other directions to move up the IoT value chain into the new “Economy of Things.” Early in 2022, Vodafone launched a new platform, called Digital Asset Broker (DAB) to help businesses across multiple industry sectors to transform physical goods into tradable digital assets. The service allows verified connected devices, vehicles, smart street furniture and machines to transact seamlessly and securely without human intervention, but with full owner control. Vodafone intends to provide secure links to many other third-party platforms and their associated device eco-systems. This is presumably to create a horizontal capability for cross-silo interactions across industries. It remains to be seen whether this is a form of Blockchain experimentation or a long-term commitment to highly automated, low human-touch data sharing. The recent experience of Maersk, the shipping company, and IBM with their TradeLens offering illustrates the challenges that Vodafone can expect to encounter. The vision for TradeLens was to digitize global supply chains via and open and neutral industry platform. While Maersk and IBM developed a viable platform, they did not secure global industry collaboration which led them to discontinue TradeLens for commercial viability reasons.

Competitiveness, Concentration and Market Exits

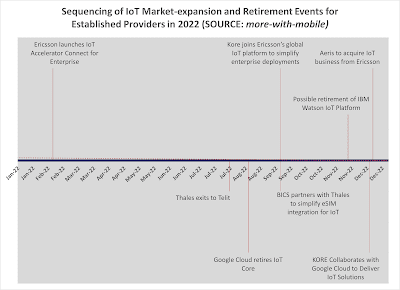

The IoT industry’s ever positive narrative of vertical-sector entry and market expansion experienced several major setbacks over 2022 in another sign of growing commercial reality. The long talked about consolidation in the cellular modules sector saw Thales selling its unit to Telit to create a new entity, Telit Cinterion. For relative newcomers to the industry, the M2M modules business was dominated by the likes of Cinterion (acquired by Gemalto and then folded into Thales), Wavecom (acquired by Sierra Wireless) and Telit. Soon after Telit’s gain Semtech, the LoRa proponent, launched discussions to acquire SierraWireless.

Economies of scale can explain consolidation in the modules market. Two other developments that surprised the IoT industry involved organizations in platform and services parts of the value chain. First came Google’s decision to exit the IoT platform business and withdraw customer support from August 2023. Later in the year, Google’s Cloud unit established a go to market alliance with KORE to provide a rich set of 'one stop shop' services to orchestrate IoT devices, global connectivity, services, data handling and analytics. Google’s initiatives suggest that a withdrawal from the Platform as a Service (PaaS) segment to focus on its strengths as an Infrastructure as a Service (IaaS) provider.

Ericsson’s December decision to transfer its IoT Accelerator and Connected Vehicle Cloud activities to Aeris was a second market surprise. Prior to this announcement, Ericsson’s corporate initiatives suggested continued commitment to the IoT market. In February, it launched IoT Accelerator Connect, a plug and play solution for connectivity, aiming to make IoT connectivity easier than ever for enterprises. During September, KORE joined Ericsson’s IoT Accelerator ecosystem, apparently filling in a North American role that Sprint previously occupied until the latter’s acquisition by T-Mobile USA. Ericsson explained its exit to Aeris by reference to the need for consolidation in a fragmented market and the unsustainable financial losses associated with its IoT business model.

Finally, there is a not fully substantiated story that IBM plans to retire its Watson IoT platform service.

Missed Opportunities and User-led Market Development

Might the realism and shake out of the supply side of the industry be signaling a shift to demand-side initiatives? Attempts to tie users to a particular technology or partner ecosystem might solve narrow use-case opportunities. As systems evolve and new requirements arise, the next stage of development calls for investment in customization or systems integration activities. Difficulties also arise when businesses want to innovate beyond the capabilities and expertise of what one or a small group of providers can offer. This is a throwback to more than a decade when the GSMA launched its market development initiative to expand the M2M market. Still today, organizations complain about fragmentation and complexity.

The IoT market continues to be associated with significant economic value creation. The fact that so many established players – from module makers to platform providers – are exiting this market suggests a missed opportunity, or one where incumbents could not adjust their traditional business models to the characteristics of the IoT sector. The pendulum might be shifting to the demand side of the industry now that IoT technologies are mature and better understood. Specialist users might be taking matters into their own hands as in the case of Siemens acquiring Senseye a specialist IoT solution provider to capitalize on industrial IoT opportunities. For mobile network operators, this dynamic has a parallel with enterprises getting into the business of running private communications networks.

Developments To Watch

The arrival of 5G networks and technology is providing impetus to the market for private mobile networks. 5G is also associated with enhanced mobile broadband (eMBB) and ultra-reliable low latency communications (URLLC) use cases. Now, there is growing activity in the less well addressed area of massive machine type communications (mMTC). Among other research avenues, this takes the form of technologies for low-power devices that communicate intermittently and over long service lives thereby providing the foundation for massive IoT and copious data sets.

Early attention on 6G, other than for technology reasons, is directing industry efforts into geo-political, societal, vertical sector and, environmental needs. The latter few topics are closely intertwined with IoT technologies that enable remote monitoring, data sourcing, analytics and digital twins. Consequently, IoT will not disappear off the agenda of incumbents that exited or scaled back their IoT initiatives. To succeed, however, will call for difficult decisions on interoperability and genuine attempts at long-term partnering.

Overcoming fragmentation and complexity is essential for affordability and market scale. Organizations will also need to adjust their business models, allowing for value to be shared more widely and based on more cost-effective resource accounting and settlement mechanisms. That is a reality borne out of the idea that IoT need not be a zero-sum game.

IMAGE CREDITS: Raj Rana via unsplash.com and more-with-mobile.com

9 Jan 2023 update

ReplyDeleteIoT 2022 in review: The 10 Most Relevant IoT Developments of the Year according to IoT Analytics

https://iot-analytics.com/iot-2022-in-review/

12 Jan 2023 update

ReplyDeleteThe Internet of Things Infrastructure has over 4.5K+ startups that comprise of companies which are engaged in technologies and services that facilitate development of connected solutions. This companies providers hardware and software for developing IoT applications, also covers network service providers and enablers for IoT applications that includes unlicensed spectrum providers and alliances like Sigfox, LoRaWAN.

Internet of Things Infrastructure sector is one of the most active sectors for investors, with an overall funding of USD 34.3B in 1.56K companies. It is also interesting to note that around one third of the funding has been raised in the last 3 years (2020-2022).

Qualcomm Ventures, Cisco Investments, Sequoia Capital, Plug and Play Tech Center, Techstars are amongst the most active investors in this sector, by number of investments.

IoT security, device security, SoC, end to end platforms, IoT operating system are some of the top business models attracting major funding.

https://tracxn.com/d/emerging-startups/top-internet-of-things-infrastructure-startups-2023

17 January 2023 update

ReplyDeleteDanish shipping company A.P. Moller – Maersk (Maersk) has announced new smart logistics and warehouse facilities in China, Norway, and Pakistan. Each site puts focus on innovation and environmental sustainability. Maersk has also confirmed the acquisition of Danish project logistics specialist Martin Bencher Group for around $61 million.

Maersk’s stated goal is to decarbonise its entire operations by 2040. Maersk’s emissions targets entail that at least 90 percent of its global cold chain and contract logistics operations will be certified as green by 2030.

Maersk, which canned its blockchain-based TradeLens trading platform last November, said its new $174 million China warehouse, in the Lin-gang area of the Shanghai Free Trade Zone, will be a flagship venue when it opens in the third quarter of 2024. It called the facility its “first green and smart” flagship logistics centre in China.

https://enterpriseiotinsights.com/20230112/channels/news/maersk-announces-major-smart-logistics-centres-in-china-norway-pakistan

27 Jan 2023 update

ReplyDeleteAT&T is reviving its old "Connected Solutions" business unit to help navigate the intersection between 5G and IoT.

AT&T Connected Solutions is being spun out of the operator's broader Business Wireless unit, with connected cars as the first area of focus.

https://www.lightreading.com/iot/atandt-other-network-operators-navigate-iot-turmoil/d/d-id/782905

5 April 2023 update

ReplyDeletePhilips is the latest company to spell trouble for Matter’s smart home standard

For the launch of Matter, we are working together with many partners in the smart home industry. With Philips Hue, we always focus on convincing quality to meet our customers’ expectations. Therefore, we will take a little more time than originally planned for the Philips Hue Bridge software update before making it available to all consumers. We will inform you as soon as we have a concrete date for the release of the Matter software update.

https://www.androidpolice.com/philips-latest-company-spell-trouble-matters-smart-home-standard/

Belkin’s smart home brand Wemo is backing away from Matter

Wemo, Belkin’s smart home company, has paused development of Matter smart home devices. In an email exchange, Jen Wei, Vice President of Global Communications and Corporate Development at Belkin, confirmed that, while the company remains convinced that “Matter will have a significantly positive impact on the smart home industry,” it has decided to “take a big step back, regroup, and rethink’’ its approach to the smart home. Wei went on to write that Wemo will bring new Matter products to market when it can find a way to differentiate them. It seems like Wemo might be concerned its smart home gear is becoming commoditized.

https://www.theverge.com/2023/3/15/23641930/belkin-matter-wemo-smart-home

10 May 2023 update

ReplyDeleteIBM Think: Enterprise AI Platform Watsonx Introduced

IBM is launching a new, enterprise-focused AI and data platform aimed at allowing businesses to accelerate advanced AI usage with trusted data, speed and governance.

The new platform, called watsonx, was introduced by IBM CEO Arvind Krishna at IBM’s three-day annual Think conference, which started today in Orlando.

Watsonx comprises three main components:

Watsonx.ai, aimed at AI builders to train, test, tune and deploy traditional machine learning and new generative AI capabilities powered by foundation models.

Watsonx.data, a data store optimized for governed data and AI workloads, supported by governance, querying and open data formats to access and share data.

Watsonx.governance, a toolkit to enable trusted AI workflows.

https://www.iotworldtoday.com/connectivity/ibm-think-enterprise-ai-platform-watsonx-introduced

16 February 2024 update

ReplyDeleteMicrosoft 'retires' Azure IoT Central in platform rethink. After March, devs won’t be able to create new application resources, in 2027 the system will be shut down.

https://www.theregister.com/2024/02/15/microsoft_retires_azure_iot_central/

EXCLUSIVE Out of the blue Microsoft has decided to retire a key plank of its Azure IoT platform, leaving developers currently building systems high and dry.

In a statement on the Azure console, Microsoft confirmed the Azure IoT Central service is being retired on March 31, 2027.

“Starting on April 1, 2024, you won’t be able to create new application resources; however, all existing IoT Central applications will continue to function and be managed. Subscription {{subscriptionld} is not allowed to create new applications. Please create a support ticket to request an exception,” the statement to customers, seen by The Register, said.

According to a Microsoft "Learn" post from February 8, 2024, IoT Central is an IoT application platform as a service (aPaaS) designed to reduce work and costs while building, managing, and maintaining IoT solutions.

As of noon GMT, February 15, the IoT Central website is still inviting potential customers to "Try Azure for Free" or "Create a pay-as-you-go account."

Microsoft's Azure IoT offering includes three pillars: IoT Hub, IoT Edge and IoT Central.

IoT Hub is a cloud-based service that provides a "secure and scalable way to connect, monitor, and manage IoT devices and sensors," according to Microsoft. Azure IoT Edge is designed to allow devices to run cloud-based workloads locally. And Azure IoT Central is a fully managed, cloud-based IoT solution for connecting and managing devices at scale.

Central is a layer above Hub in the architecture, and Hub itself may well continue. One developer told The Register there was no warning about Hub on the Azure console. As for IoT Edge, it is "a device-focused runtime that enables you to deploy, run, and monitor containerized Linux workloads."

Microsoft has not said whether this would continue. The Reg contacted the Redmond-based software giant for comment.

In 2019, Microsoft and satellite comms company Inmarsat announced an integration that would allow customers to move data up to the Azure IoT Central platform for analysis via Inmarsat's sat-com network.

21 February 2024 update

ReplyDeleteMicrosoft's commitment to Azure IoT

There was a recent erroneous system message on Feb 14th regarding the deprecation of Azure IoT Central. The error message stated that Azure IoT Central will be deprecated on March 31st, 2027 and starting April 1, 2024, you won’t be able to create new application resources. This message is not accurate and was presented in error.

Microsoft does not communicate product retirements using system messages. When we do announce Azure product retirements, we follow our standard Azure service notification process including a notification period of 3-years before discontinuing support. We understand the importance of product retirement information for our customers' planning and operations. Learn more about this process here: 3-Year Notification Subset - Microsoft Lifecycle | Microsoft Learn

Our goal is to provide our customers with a comprehensive, secure, and scalable IoT platform. We want to empower our customers to build and manage IoT solutions that can adapt to any scenario, across any industry, and at any scale. We see our IoT product portfolio as a key part of the adaptive cloud approach.

The adaptive cloud approach can help customers accelerate their industrial transformation journey by scaling adoption of IoT technologies. It helps unify siloed teams, distributed sites, and sprawling systems into a single operations, security, application, and data model, enabling organizations to leverage cloud-native and AI technologies to work simultaneously across hybrid, edge, and IoT. Learn more about our adaptive cloud approach here: Harmonizing AI-enhanced physical and cloud operations | Microsoft Azure Blog

https://techcommunity.microsoft.com/t5/internet-of-things-blog/microsoft-s-commitment-to-azure-iot/ba-p/4059725

15 March 2024 update

ReplyDeleteNavigating Your IoT Strategy Amid Microsoft IoT Central Updates

Initial alarm over Microsoft’s IoT Central platform’s fate underscores the necessity for ongoing vigilance and multi-cloud strategies in the rapidly evolving IoT landscape.

https://blog.softwareag.com/iot-strategy-post-microsoft-update/